Exploring Truist Bank: A Comprehensive Guide to Locations, Services, and Insights

### Introduction

In the dynamic world of banking, the choice of financial institution can significantly impact individuals and businesses alike. One prominent player in the American banking sector is Truist Bank, a merger between BB&T (Branch Banking and Trust Company) and SunTrust Banks, Inc., which took place in December 2019. Truist Bank emerges as a key entity, providing a myriad of financial products and services to diverse clientele. This article delves into the intricate details surrounding Truist Bank, primarily emphasizing how to locate it in your vicinity, alongside an exploration of its offerings, history, and the implications of its services on consumers and businesses.

### The Formation of Truist Bank

#### 1. Background of the Merger

The merger that gave rise to Truist Bank is a pivotal event in the banking landscape. BB&T, established in 1872, and SunTrust, founded in 1891, both have rich legacies in the financial arena. The merger aimed to create a more formidable institution with an enhanced capability to serve clients. With a combined history of over 250 years in banking, Truist was positioned to offer a robust array of services.

#### 2. Objectives of the Merger

The primary objectives behind the merger were to achieve economies of scale, enhance customer experience, and leverage technology. By combining resources, Truist aimed to streamline operations, cutting costs while enhancing service quality. This merger was also strategically timed to harness the potential of digital banking, making it essential during the COVID-19 pandemic era.

### Finding Truist Bank Near You

#### 1. Branch Locator Tools

Locating a Truist Bank branch nearby is a seamless process:

* **Online Branch Locator**: The official Truist Bank website features a branch locator tool. By entering your zip code or city, the tool provides a list of nearby branches, along with their hours of operation and services offered.

* **Mobile App**: Truist’s mobile app is equipped with location services that enable users to find the nearest bank branches and ATMs. This feature is particularly helpful for customers on the go.

* **Customer Service Support**: For those who prefer human interaction, calling Truist’s customer service allows customers to get information on branch locations and services.

#### 2. Factors to Consider When Choosing a Location

When searching for a Truist Bank nearby, consider several factors:

* **Services Offered**: Not all branches have the same services. Some may focus on retail banking, while others might offer investment services or specialized commercial banking.

* **Operating Hours**: Branch hours can vary, so it is advisable to check this information beforehand, especially if you visit after standard working hours.

* **Accessibility**: Check for ADA compliance and other accessibility features if you have specific needs.

### Services Offered by Truist Bank

Truist Bank offers a comprehensive suite of services tailored to meet the needs of individuals and businesses.

#### 1. Personal Banking

* **Checking and Savings Accounts**: Truist offers various checking and savings account options, each with specific features and benefits, catering to different customer needs.

* **Credit and Debit Cards**: Customers have access to multiple credit and debit card options that come with rewards, cashback options, and low-interest rates.

* **Loans and Mortgages**: A key offering includes personal loans, auto loans, and mortgages. Truist aims to simplify the loan application process, making it user-friendly.

#### 2. Business Banking

* **Commercial Lending**: Truist provides tailored lending solutions for small to large businesses, including lines of credit, term loans, and equipment financing.

* **Cash Management**: Businesses can benefit from various cash management solutions designed to optimize liquidity and manage daily transactions effectively.

* **Merchant Services**: Truist offers payment processing solutions to help businesses streamline their transactions with customers.

#### 3. Wealth Management

* **Investment Services**: Wealth management is another critical aspect of Truist Bank’s offerings, including investment advisory services designed for individuals and institutions.

* **Retirement Planning**: Services related to retirement accounts, including IRAs and 401(k) plans, assist customers in planning for their financial future.

* **Trust Services**: Truist also offers estate planning and trust services to help clients manage their wealth across generations.

### Truist Bank’s Digital Transformation

The digital banking landscape has been rapidly evolving, with consumers increasingly seeking online and mobile banking services. Truist Bank has strategically invested in digital transformation.

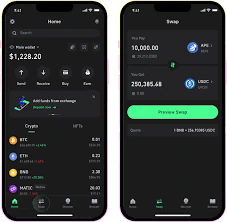

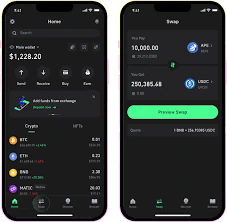

#### 1. Mobile Banking

Truist’s mobile banking application allows customers to manage their accounts, transfer funds, pay bills, and deposit checks with just a few taps on their smartphones. Security features, such as biometric logins and two-factor authentication, ensure the safety of customer information.

#### 2. Online Banking

Truist’s online platform enhances user experience by providing robust functionalities. Customers can monitor their accounts in real-time, access financial planning tools, and apply for loans or credit cards without stepping foot in a branch.

#### 3. Security Measures

In an era where cyber threats are a concern, Truist Bank prioritizes security. They employ advanced encryption techniques, multi-factor authentication, and continuous monitoring to safeguard customer data. Additionally, Truist provides educational resources to help customers recognize potential fraud and phishing attacks.

### Customer Experience and Feedback

Understanding customer experiences is pivotal in assessing a bank’s effectiveness. Truist Bank has made strides to ensure customer satisfaction through various channels.

#### 1. Customer Service

Truist offers comprehensive customer service through multiple channels, including phone, chat, and in-branch consultations. Customers have reported favorable experiences, particularly with personalized services offered by relationship managers.

#### 2. Community Engagement

Truist actively engages with local communities, providing financial literacy programs and participating in charitable activities. This engagement not only strengthens community ties but also enhances the bank’s brand reputation.

#### 3. Customer Reviews

Analyzing customer feedback on third-party review platforms often reveals insights into common issues and praises about Truist Bank. While many customers commend the bank for its wide range of services and customer support, some reviews highlight challenges related to the transition post-merger, indicating areas needing attention.

### The Future of Truist Bank

As Truist Bank pivots to adapt to changing market dynamics and consumer behaviors, several trends are visible:

#### 1. Increased Digital Offerings

With the banking sector moving towards digital-first strategies, Truist is likely to expand its online and mobile banking features, ensuring convenience for tech-savvy customers.

#### 2. Sustainable Banking Practices

Truist is positioning itself as a socially responsible entity by investing in sustainable initiatives. This includes funding environmentally friendly projects and offering green loans for businesses and individuals looking to invest in sustainable technologies.

#### 3. Financial Inclusion Efforts

Truist’s commitment to financial inclusion aims to provide banking services to underserved communities. By promoting accessible accounts and lending options, the bank seeks to bridge the gap for those traditionally excluded from the banking system.

### Conclusion

In summary, Truist Bank is more than just a financial institution; it is a comprehensive provider of banking solutions born from a significant merger that seeks to cater to the diverse needs of individuals and businesses. With its commitment to excellent customer service, extensive service offerings, and ongoing focus on digital transformation, Truist continues to carve its niche in the competitive banking landscape. For anyone looking to find a branch near them, the resources available make accessing Truist’s offerings convenient and efficient.

As Truist moves forward, keeping an eye on emerging trends such as digital adaptation and sustainability will be critical in understanding its evolution and impact on the banking industry. Whether you’re searching for a local branch or considering utilizing its services, Truist Bank stands ready to meet your financial needs in a rapidly changing world.