# Understanding Trust Wallet: Fees and Cost Structure

Trust Wallet has gained significant popularity as a cryptocurrency wallet, particularly for those looking to store, swap, and stake their digital assets securely. As more users join the cryptocurrency ecosystem, understanding the fee structure associated with Trust Wallet becomes essential. This article aims to delve deeply into the aspects of fees in Trust Wallet, exploring not just the costs but also the implications and the rationale behind them.

## What is Trust Wallet?

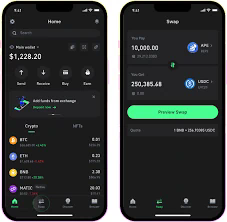

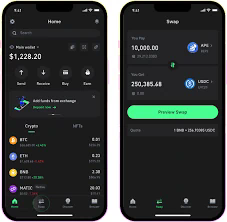

Before diving into the fee structure, it’s essential to define what Trust Wallet is. Trust Wallet is a decentralized wallet that allows users to store a wide variety of cryptocurrencies and tokens. It is a non-custodial wallet, meaning users have full control over their private keys and funds. Trust Wallet supports numerous blockchain networks, including Ethereum and Binance Smart Chain, facilitating cross-chain transactions and a seamless user experience.

## Types of Fees in Trust Wallet

Understanding the types of fees associated with Trust Wallet is crucial for users to manage their assets effectively. While Trust Wallet itself generally does not impose transaction fees, the following types of fees may apply:

### 1. Transaction Fees

Transaction fees are the most common costs users encounter when using any blockchain-based service, including Trust Wallet. These fees are typically charged by the blockchain network itself rather than Trust Wallet. For instance, when sending Ethereum (ETH) or any ERC-20 token, users must pay gas fees, which are determined by network demand and can fluctuate significantly based on congestion. It’s vital for users to be aware of how these fees work, as they can impact the overall cost of transactions.

### 2. Swap Fees

Trust Wallet offers a built-in swap feature that allows users to exchange one cryptocurrency for another directly within the wallet. While Trust Wallet does not charge a direct fee for using this service, users are responsible for covering the transaction fees associated with the underlying blockchain networks of the tokens being swapped. Moreover, there may be a small markup on the prices during swaps, depending on the liquidity providers and the market conditions.

### 3. Staking Fees

One of the notable features of Trust Wallet is the ability to stake certain cryptocurrencies directly from the wallet. Staking involves locking up funds in a network to support its operations (like validating transactions) in exchange for rewards. While Trust Wallet does not charge a fee for staking, the underlying blockchain may impose fees that can affect overall earnings. For instance, some networks may have slashing penalties or fees that affect the staking rewards distributed to users.

## How Fees Impact Cryptocurrency Transactions

### 1. User Experience

Fees significantly influence user experience in cryptocurrency transactions. A wallet that allows for low-fee transactions can enhance user satisfaction, especially for those executing numerous trades or microtransactions. Trust Wallet’s fee structure aims to provide flexibility, enabling users to choose transaction speeds based on their willingness to pay higher fees for quicker confirmations.

### 2. Market Conditions

Market conditions can drastically affect fees, particularly transaction fees. During times of high volatility or increased network activity, users may face unexpectedly high transaction fees, impacting their overall trading strategy. This dynamic nature of fees necessitates that users stay informed about market trends and network conditions when making transactions.

## Best Practices for Managing Fees in Trust Wallet

### 1. Timing Transactions

To manage fees effectively, users can time their transactions based on network congestion and gas prices. Tools like Gas Tracker provide real-time information about gas prices, allowing users to determine the optimal time to make a transaction for minimal fees. Trust Wallet users should regularly consult these tools to enhance their cost-efficiency.

### 2. Exploring Alternative Networks

As Trust Wallet supports multiple blockchain networks, users can explore alternatives when conducting transactions. For instance, users may find that transaction fees are lower on Binance Smart Chain compared to Ethereum during high traffic periods. Understanding the fee structures of different networks can lead to cost savings and more efficient transactions.

### 3. Using the Swap Function Wisely

When utilizing the swap function, users should be mindful of the conditions and fees associated with each transaction. Evaluating current market rates and potential slippage can help users make informed decisions, ensuring they don’t end up on the losing side of a transaction due to hidden fees.

## Understanding Gas Fees

Gas fees constitute a critical component of transaction costs on networks like Ethereum. These fees are paid to miners for processing transactions, and their structures can be complicated. Specifically, gas fee calculations involve two parameters:

### 1. Gas Price

Gas price is the amount users are willing to pay per unit of gas, typically measured in gwei (a denomination of ETH). Users can set higher gas prices to expedite their transactions during busy periods, though this comes at the cost of increased expenses.

### 2. Gas Limit

Gas limit refers to the maximum amount of gas units a user is willing to consume for a transaction. Setting an appropriate gas limit is vital: too low may result in transaction failure, while too high can unnecessarily inflate costs.

## Trust Wallet’s Competitive Edge

In a crowded market of cryptocurrency wallets, Trust Wallet maintains a competitive edge primarily due to its ease of use, extensive support for various cryptocurrencies, and low fees. By providing a platform where users can trade, stake, and store cryptocurrencies securely, Trust Wallet appeals to both novice and experienced users.

### 1. Decentralized Nature

The decentralized nature of Trust Wallet means users are not subjected to the high costs and restrictions often associated with centralized exchanges. This independence from centralized entities can lead to lower fees and improved user control over their funds.

### 2. Integration with DApps

Trust Wallet’s seamless integration with decentralized applications (DApps) enhances its user experience and utility. DApps often have their own fee structures, and using Trust Wallet can reduce the friction associated with accessing these services, thereby cutting unnecessary costs.

## Conclusion

While Trust Wallet may not impose direct fees, users must navigate transaction, swap, and potential staking fees inherent in the blockchain networks they interact with. Understanding this fee structure is vital for users to optimize their cryptocurrency transactions effectively. Furthermore, by employing strategies to manage and reduce fees, users can enhance their overall experience within the Trust Wallet ecosystem.

In conclusion, Trust Wallet serves as a valuable asset for cryptocurrency users, offering a low-cost, user-friendly platform for managing a diverse portfolio of digital assets. Its unique blend of features, combined with a keen understanding of fees, creates an informed user experience that empowers individuals in the ever-evolving world of cryptocurrency. Users who take the time to understand and strategically manage their fees can significantly enhance their cryptocurrency management efforts, ultimately reaping greater rewards as they navigate this burgeoning landscape.