Does Trust Wallet Have a Debit Card? A Comprehensive Analysis

### Introduction to Trust Wallet

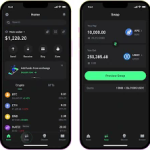

Trust Wallet is a popular decentralized wallet designed for mobile devices that allows users to store, manage, and exchange a variety of cryptocurrencies. Acquired by Binance in 2018, Trust Wallet has gained significant traction in the crypto community for its user-friendly interface and robust security features. While many users associate Trust Wallet with crypto storage and management, the question remains: does Trust Wallet offer a debit card? In this article, we will explore this topic in depth, covering the functionalities of Trust Wallet, the concept of crypto debit cards, and available alternatives.

### Understanding Crypto Debit Cards

Before we delve into whether Trust Wallet has a debit card, it’s essential to understand what a crypto debit card is. A crypto debit card functions similarly to traditional debit cards, allowing users to make purchases or withdraw cash using their cryptocurrencies. These cards typically convert cryptocurrency into local currency at the point of sale, enabling users to spend their digital assets directly in the real world.

Notable crypto debit cards include those offered by companies like Coinbase, BitPay, and Crypto.com, which enable users to transact with their cryptocurrencies easily. Additionally, the underlying technology often connects to a cryptocurrency wallet, providing users with a seamless spending experience.

### Trust Wallet Features and Capabilities

Trust Wallet boasts several features that make it an attractive option for crypto enthusiasts. Users can manage a diverse range of cryptocurrencies, including popular options like Bitcoin, Ethereum, and ERC-20 tokens. Additionally, Trust Wallet offers integrated decentralized exchanges, allowing users to swap tokens without leaving the app.

Moreover, Trust Wallet emphasizes user privacy and security. It gives users full control over their private keys and doesn’t require personal information to set up an account. The wallet also includes a DApp browser, which allows users to interact with decentralized applications directly, fostering an ecosystem that promotes decentralized finance (DeFi) and other emerging blockchain technologies.

### The Current Status of Trust Wallet Debit Card Availability

As of October 2023, Trust Wallet does not issue its own debit card. Unlike some wallet providers, Trust Wallet focuses primarily on providing a safe and efficient platform for managing cryptocurrencies rather than venturing into traditional banking services. However, this does not mean users cannot spend their crypto through other means connected to Trust Wallet.

While Trust Wallet lacks a proprietary debit card, users can explore various alternatives. Several companies and platforms that offer crypto debit cards can be linked to Trust Wallet, allowing users to spend their cryptocurrencies through those services.

### Alternatives: Third-Party Crypto Debit Cards

Because Trust Wallet does not provide a debit card, various third-party solutions exist that enable users to access similar functionality. Let’s explore some prominent options:

#### 1. Binance Visa Card

As a product of the same parent company as Trust Wallet, the Binance Visa Card allows users to convert cryptocurrency into fiat currency for seamless spending. This card connects directly with users’ Binance accounts, but for Trust Wallet users, there are ways to transfer assets between platforms prior to card usage.

#### 2. Crypto.com Card

Crypto.com offers a high-profile debit card that supports multiple cryptocurrencies and provides various benefits such as cashback rewards and staking opportunities. Users can transfer crypto from Trust Wallet to their Crypto.com wallet before utilizing the card.

#### 3. BitPay Card

The BitPay card is another reliable option, allowing users to convert Bitcoin (and other cryptocurrencies) to fiat for spending. The card can be loaded with funds from a connected wallet, making it a flexible choice for Trust Wallet users who want to spend their assets effectively.

### The Process of Using Third-Party Cards with Trust Wallet

To utilize a third-party debit card in conjunction with Trust Wallet, users typically need to follow a few steps:

1. **Choose a Card Provider:** Based on their specific spending habits and preferences, users should research and select a crypto debit card provider that suits their needs.

2. **Set Up an Account:** After selecting a provider, users must create an account with the card provider and complete any necessary identity verification steps.

3. **Transfer Assets:** Users can transfer the desired amount of crypto from Trust Wallet to their chosen debit card provider’s wallet. This step usually involves generating a wallet address from the card provider and initiating a transfer from Trust Wallet.

4. **Load Funds to the Debit Card:** Once the crypto is in the card provider’s wallet, users can load funds onto their debit card, making it ready for use in transactions.

5. **Spend Crypto:** With the debit card funded, users can now spend their crypto at any location that accepts the card, enjoying the benefits of using their digital assets in everyday purchases.

### Regulatory Considerations: A Must-Know Aspect

The rise of crypto debit cards has brought about various regulatory considerations in multiple jurisdictions. Users must pay attention to their local laws and regulations concerning cryptocurrency spending. For example, the taxation of crypto transactions can vary greatly by location, and how one utilizes their digital assets may have reporting implications.

Additionally, certain card providers may restrict access based on geographical location or regulatory requirements. Therefore, it’s of utmost importance for users to conduct thorough research and stay informed about the rules governing the use of crypto debit cards in their area.

### Security Concerns: Spending Your Crypto with a Debit Card

While using a debit card linked to cryptocurrency can provide convenience, it’s not without potential risks. Users must ensure they select a reputable card provider that employs robust security measures. Key elements to consider include:

– **Two-Factor Authentication (2FA):** A must-have for accounts linked to financial transactions.

– **Encryption Standards:** High-grade encryption methods are essential for safeguarding personal and financial data.

– **Customer Support:** Reliable customer service in case of problems or disputes with transactions.

Users must also be vigilant about phishing scams and other cyber threats that could target their wallets or card accounts. Being proactive in security measures is vital in preserving the integrity of one’s assets.

### Conclusion: Future Prospects for Trust Wallet and Debit Cards

As of now, Trust Wallet does not offer its own debit card arrangements. However, its alliance with Binance coupled with the wide availability of third-party crypto debit cards means that users can still utilize their assets for spending. The growing cryptocurrency landscape suggests that the integration of banking services, including debit cards, into wallets may become more commonplace in the future.

Trust Wallet’s focus on decentralized asset management allows users to retain control over their cryptocurrencies. Still, the potential rises for further innovation—from enhanced partnerships to direct integrations of debit card functionalities. Users should keep an eye on developments in the ecosystem as the relationship between decentralized wallets like Trust Wallet and traditional financial instruments continues to evolve.

In summary, while Trust Wallet may not currently offer a debit card, there are several avenues for users to spend their crypto assets effectively. By understanding the options available and remaining vigilant about regulatory and security considerations, users can enjoy the benefits of using their cryptocurrencies in everyday transactions.