# Introduction to Trust Wallet

In the rapidly evolving world of cryptocurrencies, Trust Wallet has emerged as a prominent player in the digital asset management space. As an open-source mobile wallet, it allows users to store, manage, and exchange a wide range of cryptocurrencies seamlessly. Since its acquisition by Binance in 2018, Trust Wallet has gained popularity among crypto enthusiasts due to its user-friendly interface, robust security features, and compatibility with decentralized applications (dApps). One of the frequently asked questions among users is whether Trust Wallet accepts credit cards for purchasing cryptocurrencies. This article will delve into this question, explore the functionalities of Trust Wallet, and discuss the various payment methods available for users.

# Understanding Trust Wallet’s Core Features

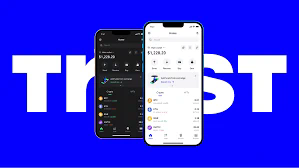

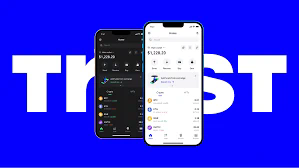

## User-Friendly Interface

Trust Wallet is designed with simplicity in mind, providing a straightforward interface that caters to both beginners and experienced users. The wallet enables users to create an account in a matter of minutes, requiring only a recovery phrase for security. Navigating through multiple features, such as transaction history, balance checks, and market tracking, is intuitive and requires minimal learning curve.

## Security and Privacy

Trust Wallet prioritizes user security by implementing various protection measures. Private keys are stored locally on users’ devices, which means that only the wallet holder has access. The wallet does not store user data on any centralized servers, ensuring that privacy is maintained. Additionally, Trust Wallet employs encryption methods to safeguard sensitive information, making it a secure choice for managing digital assets.

## Support for Multiple Cryptocurrencies

One of the standout features of Trust Wallet is its support for a vast array of cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and a variety of tokens based on the ERC-20 and BEP-20 standards. This versatility enables users to manage different assets in a single application, eliminating the need to download multiple wallets for various cryptocurrencies.

## Integration with DApps

Trust Wallet’s integration with decentralized applications (dApps) is another notable aspect. Users can seamlessly interact with various DeFi platforms, NFT marketplaces, and other dApps directly from the wallet interface. This functionality enhances the overall trading experience and allows for greater engagement with the ever-expanding world of decentralized finance.

# Payment Methods for Acquiring Cryptocurrencies

## Traditional Methods: Bank Transfers and Cash

Traditionally, buying cryptocurrencies often involved fiat currency transfers from a bank account. Numerous trading platforms – including exchanges – supported this method. Users would typically create an account, verify their identity, and deposit funds via bank transfer before buying crypto. However, this process can be time-consuming and may involve additional fees.

## Credit and Debit Card Payments

As the demand for convenience surges, many platforms have begun accepting credit and debit card payments for cryptocurrency purchases. This method allows users to buy digital assets instantly, making it one of the fastest options available. Credit cards can be utilized through various exchanges that support Trust Wallet. Customers can enter their card information, purchase their desired crypto, and then transfer it directly to their Trust Wallet.

## Trust Wallet’s Relationship with Payment Processing Partners

Although Trust Wallet does not directly process payments through credit cards, it has partnered with various third-party services that facilitate credit card transactions. These partners may include leading payment processors like MoonPay, Simplex, and others. By leveraging these partnerships, Trust Wallet users can purchase cryptocurrencies using their credit cards through the integrated platforms within the wallet.

# Detailed Analysis of Credit Card Transactions in Trust Wallet

## Step-by-Step Process to Buy Crypto with a Credit Card

1. **Select a Platform**: Users can choose platforms integrated into Trust Wallet that support credit card payments, such as MoonPay or Simplex.

2. **Choose the Cryptocurrency**: Once on the selected platform, users select which cryptocurrency they wish to purchase.

3. **Enter Personal Information**: Depending on the platform, users may be required to enter some personal information, including name, email address, and payment details.

4. **Verify Identity**: Some platforms may require identity verification to comply with regulations. Users may need to upload a government-issued ID and a selfie.

5. **Make the Purchase**: After verification, users can confirm the transaction and enter their Trust Wallet address to receive the purchased cryptocurrency.

6. **Transaction Confirmation**: Following the completion of the payment, users will receive a notification regarding the status of their transaction.

## Fees Associated with Credit Card Transactions

While using a credit card can be convenient, users should be aware of the potential fees that may accompany this payment method. Transaction fees may be higher compared to bank transfers due to the additional payment processing costs. Credit card companies may also impose a cash advance fee if the purchase is classified as a cash transaction. Users should thoroughly review the payment terms and associated fees before proceeding with any transaction.

## Security Considerations with Credit Card Purchases

While Trust Wallet provides a secure environment for cryptocurrency management, users should exercise caution when providing credit card information. It is advisable to use reputable payment processors and ensure that any transaction occurs over a secure, encrypted connection. Additionally, maintaining up-to-date antivirus software can help protect users from potential threats while engaging in online transactions.

# Comparison of Payment Methods: Credit Cards vs. Alternatives

## Convenience of Credit Card Payments

One of the most significant advantages of credit card purchases is convenience. Users can buy cryptocurrencies quickly, often in a matter of minutes, directly from their smartphones. This immediacy appeals to those who want to take advantage of market opportunities without delays.

## Alternatives: Bank Transfers and E-Wallets

While credit cards offer speed, bank transfers and e-wallets like PayPal, Skrill, or Neteller present alternative methods that may incur lower fees and have fewer restrictions. Bank transfers typically offer larger transaction limits, making them suitable for larger investments. E-wallets provide a blend of speed and convenience, though they may still require users to verify their identities.

## Security Risks and Regulations

Every payment method comes with inherent risks and regulatory considerations. Credit card transactions can be reversed, posing a risk to sellers. In contrast, cryptocurrency transactions are immutable, providing certainty to buyers and sellers once completed. Users must evaluate these factors when choosing their preferred payment method.

# Conclusion: Navigating the World of Trust Wallet

As cryptocurrency becomes increasingly mainstream, tools like Trust Wallet continue to evolve to meet user demands. Trust Wallet supports various payment methods, including the ability to buy cryptocurrencies with credit cards through third-party services. While credit cards offer instant purchasing capabilities, users must consider transaction fees and security implications.

Discerning users should explore all available payment options to find what best suits their needs. Understanding the functionalities and partnerships of Trust Wallet allows for improved decision-making when it comes to managing digital assets.

In the dynamic landscape of cryptocurrencies, staying informed about evolving technologies and practices is critical. Trust Wallet, with its integration of various payment options and emphasis on user security, is well-positioned to lead the way in the future of digital asset management.