# Understanding Trust Wallet and KYC: A Comprehensive Analysis

## Introduction to Trust Wallet

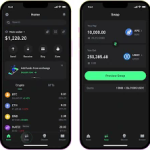

Trust Wallet is a widely used mobile cryptocurrency wallet that allows users to store, manage, and trade various cryptocurrencies. Acquired by Binance in 2018, it has been designed with user experience and security in mind, supporting thousands of digital assets. Since its inception, Trust Wallet has gained popularity due to its emphasis on user control over private keys, decentralized transactions, and a user-friendly interface.

## The Concept of KYC

KYC stands for “Know Your Customer,” a process used by financial institutions and certain businesses to verify the identity of their clients. It is a critical compliance measure aimed at preventing fraud, money laundering, and the financing of terrorism. KYC procedures typically involve collecting identification documents, proof of address, and sometimes video verification to ensure that clients’ identities are legitimate.

## KYC in the Cryptocurrency Landscape

The cryptocurrency industry has seen mixed reactions to KYC regulations. On the one hand, compliance with KYC laws contributes to greater legitimacy and security within the space. On the other hand, many crypto enthusiasts advocate for privacy and decentralization, arguing that KYC procedures can undermine the core principles of cryptocurrencies. Different exchanges and wallets have varying approaches to KYC, with some requiring it before allowing trades or swaps, and others remaining KYC-free.

## Does Trust Wallet Implement KYC?

At its core, Trust Wallet is a non-custodial wallet, which means that users have full control over their private keys and funds. Notably, Trust Wallet does not impose KYC procedures on users for basic wallet functionalities like storage and sending of cryptocurrencies. Users can create a wallet, receive, and send cryptocurrencies without providing personal information.

However, it is important to note that while Trust Wallet itself does not require KYC, the integrations and services offered within the app may involve third-party exchanges or platforms that do implement KYC. For example, if a user decides to use a decentralized exchange (DEX) integrated with Trust Wallet, they may encounter KYC requirements set by that platform.

## The Implications of Not Having KYC

The absence of KYC in Trust Wallet has several implications:

### 1. Enhanced Privacy

With no KYC requirements, users can enjoy a higher level of privacy and anonymity. This appeals to many individuals who prioritize their financial privacy, allowing them to conduct transactions without fear of surveillance or data breaches.

### 2. Risk of Illegal Activities

The lack of KYC measures can also create opportunities for illicit activities, such as money laundering or fraud. While the cryptocurrency industry is often criticized for being a haven for criminals, many argue that the technologies underpinning crypto can provide more transparency than traditional financial systems, provided they are used correctly.

### 3. Regulatory Scrutiny

The evolving regulatory landscape poses challenges for platforms that do not implement KYC. Governments worldwide are increasingly focusing on regulating cryptocurrencies, which could lead to a scenario where non-compliant wallets face legal repercussions or restrictions.

## Trust Wallet Security Features

Security is a prime concern for cryptocurrency users, and Trust Wallet has several features to ensure the safety of users’ funds. It operates as a non-custodial wallet, meaning that users retain full control of their private keys. Trust Wallet also implements security practices such as:

### 1. Private Key Management

Users generate their private keys locally on their devices. This ensures that private keys are never transmitted over the internet, reducing the risk of hacks or thefts. Furthermore, Trust Wallet supports backup options, allowing users to recover their wallets in case of device loss or failure.

### 2. Biometric Authentication

Trust Wallet provides biometric authentication options such as fingerprint or facial recognition, adding an extra layer of security to access the wallet.

### 3. Decentralized Architecture

Trust Wallet is a decentralized application (dApp) that reduces the risk of centralized attacks. Since there is no central server storing user data, the risk of mass hacks is significantly decreased.

## How KYC Shapes User Experience

The implementation of KYC procedures can significantly impact user experience. Some key aspects include:

### 1. Time and Complexity

KYC processes often involve multiple steps, including document submission and verification, which can introduce delays in accessing services. This can frustrate users seeking a seamless experience, especially in a market where speed is often essential.

### 2. Trust and Credibility

Conversely, KYC can build trust between users and platforms. Users may feel more secure using an exchange or wallet that has thorough KYC processes, as it implies a level of regulation and accountability.

### 3. Accessibility Issues

KYC procedures may disproportionately affect users in regions with limited access to verification documents. Individuals without proper identification may be excluded from participating in the crypto ecosystem, which contradicts the principle of inclusivity that cryptocurrencies aim to provide.

## The Future of KYC in Decentralized Finance (DeFi)

As the DeFi space continues to grow, the role of KYC is under ongoing debate. DeFi aims to eliminate intermediaries in financial transactions, relying on code and smart contracts rather than traditional regulations. The future of KYC in this space may involve innovative solutions that balance privacy, security, and regulatory compliance, such as:

### 1. Decentralized Identity Solutions

Emerging technologies, such as decentralized identity systems, may offer ways for users to prove their identity without compromising their privacy. This could allow users to verify their identity once while still interacting with multiple services without repeatedly undergoing KYC procedures.

### 2. Adaptive KYC

Some projects are exploring adaptive KYC models, where the extent of verification required is proportional to the level of risk involved in the transaction. This would allow for a more flexible approach, protecting both users and platforms.

## Conclusion

Trust Wallet stands out in the cryptocurrency landscape due to its user-friendly design, security features, and non-custodial nature. While it does not require KYC for its core functionalities, the implications of KYC regulations are complex and multifaceted. The future of KYC in cryptocurrencies and DeFi will likely evolve as the industry continues to grapple with the balance between privacy, security, compliance, and user experience. Through ongoing discourse, innovation in identity verification technologies, and adaptive KYC models, the landscape may transform to better serve the needs of all users while maintaining the fundamental principles of the cryptocurrency revolution.

Ultimately, understanding the nuances of KYC and its relation to wallets like Trust Wallet is vital for users looking to navigate this dynamic and rapidly changing sector.