Can I Use Trust Wallet in New York? An In-Depth Analysis of Cryptocurrency Wallets and Regulations

### Introduction to Trust Wallet and Its Features

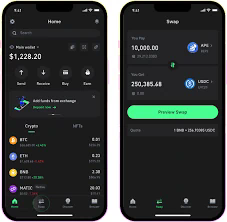

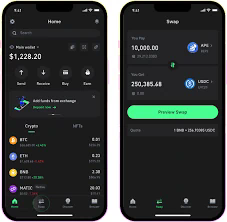

Trust Wallet is a popular cryptocurrency wallet designed for both beginners and advanced users. It supports a wide range of cryptocurrencies and tokens, allowing users to store, manage, and trade their digital assets from a single application. One of its most significant advantages is that it’s a non-custodial wallet, meaning that users have complete control over their private keys. This feature enhances security and privacy, as users are not reliant on a third-party service to hold their funds.

In addition to storing cryptocurrencies, Trust Wallet also offers an integrated decentralized exchange (DEX) that enables users to trade directly from the wallet without needing to transfer their assets to a centralized exchange. The user-friendly interface and additional features, such as support for NFTs and staking options, make Trust Wallet a versatile choice for cryptocurrency enthusiasts. However, the legality and usability of Trust Wallet in different regions, particularly in New York, is a topic of growing interest.

### The Legal Landscape of Cryptocurrency in New York

New York is known for its stringent regulations concerning cryptocurrencies and blockchain technology. The state is home to the BitLicense, a regulatory framework introduced by the New York State Department of Financial Services (NYDFS). The BitLicense requires cryptocurrency businesses operating in New York to comply with various requirements, including consumer protection measures, anti-money laundering (AML) protocols, and capital requirements.

Given this regulatory environment, one might wonder about the legality of using wallets like Trust Wallet within the state. As of now, self-custody wallets, like Trust Wallet, are generally not subject to the same regulatory framework as exchanges or other custodial services. Users can still download and use such wallets, but they must be cautious about how they acquire and trade cryptocurrencies.

### Understanding the Risks of Using Trust Wallet

While Trust Wallet offers numerous benefits, users should remain aware of the risks associated with using any cryptocurrency wallet. The non-custodial nature of Trust Wallet means that if someone loses access to their private keys, they lose access to their funds permanently. Therefore, it is crucial to securely back up recovery phrases and private keys to ensure funds can be retrieved if necessary.

In addition, users should be vigilant against phishing attempts and scams, which are prevalent in the crypto space. Unauthorized apps and websites may try to trick users into providing their private information, leading to potential loss of funds. Implementing good security practices, such as using hardware wallets for large amounts of cryptocurrency and being cautious of unsolicited messages or offers, can mitigate some of these risks.

### How to Safely Use Trust Wallet in New York

To use Trust Wallet safely in New York, users should adhere to a few best practices. First and foremost, ensure that the wallet is downloaded from the official website or trusted app stores to avoid potential security threats. Once installed, enabling two-factor authentication (2FA) where possible, and keeping the app updated to the latest version can significantly enhance security.

Additionally, users should educate themselves about the specific regulations governing cryptocurrency transactions in New York. Being compliant with state laws will help users avoid potential legal issues down the line. Keeping accurate records of transactions, understanding tax implications, and ensuring that any cryptocurrency acquired is sourced legally are crucial steps for New Yorkers engaging in the crypto space.

### The Role of Decentralized Finance (DeFi) and Trust Wallet

With the rise of decentralized finance (DeFi), Trust Wallet’s role as a wallet supporting these platforms becomes increasingly significant. DeFi allows users to lend, borrow, trade, and earn interest on their assets without the need for traditional financial intermediaries. Trust Wallet facilitates access to more than just cryptocurrencies; it enables users to interact with various DeFi applications directly.

However, engagement with DeFi platforms brings its own set of challenges and risks. For example, smart contract vulnerabilities can result in unintended losses. Additionally, the decentralized nature of DeFi projects means that users are fully responsible for their funds and transactions. Therefore, conducting thorough research on any DeFi platform and understanding the underlying technologies and potential risks is paramount for safe and effective engagement.

### Implications of Tax Regulations on Cryptocurrency Users in New York

The tax implications surrounding cryptocurrency transactions are a crucial aspect for users in New York and elsewhere. The Internal Revenue Service (IRS) considers cryptocurrency as property for tax purposes, and any sale or exchange of cryptocurrency can trigger capital gains taxes. This means that individuals using Trust Wallet for trading or investing in cryptocurrencies may be liable for taxes when they realize gains or losses on their investments.

New York State also aligns with these guidelines, with additional local regulations that may apply. Therefore, users should maintain detailed records of all transactions, including the cost basis, date of acquisition, and any fees associated with buying or selling cryptocurrencies. Consulting with a tax professional knowledgeable about cryptocurrency regulations can help users navigate the complexities of tax requirements effectively.

### Future of Trust Wallet and Broader Cryptocurrency Landscape in New York

As the cryptocurrency landscape continues to evolve, so too will the regulations surrounding its use. Trust Wallet, with its increasing popularity and diverse feature set, is likely to remain a significant player in the wallet space. Its capacity to adapt to the latest developments in blockchain technology and DeFi will be key to its success.

In New York, authorities are continually updating regulations to keep pace with technological advancements in the crypto sector. Users should stay informed about any regulatory changes that may affect their ability to use Trust Wallet or other cryptocurrency wallets. Advocacy for clear and fair regulations will also play a critical role in the future of cryptocurrency in the state.

### Conclusion: Navigating the Crypto Landscape in New York

In conclusion, Trust Wallet offers an effective solution for users looking to manage their cryptocurrencies in New York. Its non-custodial nature, combined with user-friendly features, provides an excellent platform for safe and efficient cryptocurrency management. However, potential users must navigate the complex regulatory landscape and stay informed about their rights and responsibilities.

By adhering to best practices for security, understanding the legal and tax implications of using cryptocurrency, and remaining vigilant against risks, New Yorkers can successfully utilize Trust Wallet and explore the exciting opportunities presented by the world of digital assets. The future of cryptocurrency holds immense potential, and with the right knowledge and approach, users can thrive within this dynamic space.